“Contract for Difference? What is that? Why would someone want to contract a difference?” Have you ever thought about that? No? Oh… I guess I’m the only one who spends time thinking about these things. 😉

But since you’re here, let me share what I’ve learned—because, trust me, this little financial trick is the backbone of how we keep renewable energy afloat.

Why renewable energy needs a financial lifeline

Now, renewable energy seems like a cheap, magical solution. Sunlight and wind are free, right? But here’s the kicker—these sources are as unpredictable as your cat’s mood. The sun doesn’t shine 24/7, the wind takes unexpected coffee breaks, and hydropower? Well, sometimes rivers get lazy too.

This uncertainty makes life brutal for renewable energy producers. Imagine walking into a bank, asking for a multi-million-dollar loan to build a wind farm, and when they ask, “How much will you sell your product for?”, your answer is:

💨 “Uh… no idea. Could be $100, could be $10. Depends on the weather.”

Yeah, good luck with that. Banks love certainty, and nothing screams ‘risky business’ like relying on Mother Nature’s mood swings to set your revenue. Market prices swing wildly due to demand, government policies, and world events.

Contract for Difference: The energy market’s cheat code

Here’s where a Contract for Difference (CFD) steps in like a financial superhero. It guarantees a fixed price for electricity, no matter how the market behaves.

If prices crash, the producer gets paid the difference. If prices soar, they return the extra cash.

Sounds smart, right? That’s why CFDs play a massive role in making renewables viable.

So, let’s dive into how this works, why it matters, and whether it really makes energy cheaper.

Welcome to 1000whats, where we make energy topics easy and fun for everyone! ⚡

What is Contract for Difference (CFD)?

Let’s play a game. Imagine you and a friend are obsessed with coffee (which, let’s be honest, isn’t hard to imagine). You both wonder what the price of a cup will be next month.

- You think coffee will get more expensive, say $5.

- Your friend thinks it’ll be cheaper.

So, you make a deal: if coffee costs less than $5, your friend pays you the difference. If it costs more than $5, you pay them the extra. No actual coffee changes hands—it’s just a bet on price changes.

Boom! You’ve just invented a Contract for Difference (CFD). 🎉

📢 A Contract for Difference (CFD) is a financial agreement where two parties exchange the difference between an agreed-upon price and the actual market price. 📊

From coffee to clean energy

CFDs weren’t invented for coffee lovers, though.

They come from economics and were first used in financial trading. But the energy industry quickly realized they could use CFDs to deal with unpredictable electricity prices.

Think about it—renewable energy producers invest millions in wind turbines, solar farms, and hydro plants. But the price of electricity changes all the time. If prices crash, they lose money. If prices skyrocket, consumers get stuck paying insane bills.

📢 Contracts for Difference (CFDs) stabilize electricity prices, making renewable energy a safer investment. ⚡💰

That’s why governments, investors, and energy companies love CFDs. They reduce financial risk and keep the green energy revolution rolling. 🌱

Alright, now that we get what a CFD is, let’s see how it actually works! 🚀

How does a Contract for Difference (CFD) work?

Let’s step away from the world of power plants for a moment and take a trip to a small fishing village.

Picture this: you’re a fisherman, heading out to sea every morning with your trusty boat. At midday, you return to the village market to sell your fish.

Sounds simple, right? Well, here’s the problem…

The price of fish changes every day. Sometimes tourists flood in, and fancy restaurants are willing to pay $7 per kilogram. Other days, it’s just the locals, and you can barely get $3 per kilogram. Yesterday was great, but today? Not so much.

📢 Inconsistent prices make it hard to plan, invest, or even survive as a fisherman.

Now, here comes the clever bank owner. He sees your struggle and offers you a deal:

💡 “Let’s fix your price at $5 per kilogram, no matter what happens at the market.”

How the deal works 💰🔄

- Every day, you go fishing as usual and sell your catch at the village market.

- Afterward, you visit the bank owner and settle the difference:

✔ If the market price is below $5, say $3, the bank owner pays you the missing $2 per kilogram. Now, you still earn $5/kg. ✅

✔ If the market price is above $5, say $7, you pay the bank owner $2 per kilogram. That way, for you, the price stays at $5/kg. ✅

For you, the fisherman, this is great—you know exactly how much money you’ll make, and you can plan your expenses.

For the bank owner, this is a business opportunity. He doesn’t fish or visit the market, but by taking on some risk, he has a chance to profit when prices go up.

📢 This is exactly how a Contract for Difference (CFD) works in renewable energy. ⚡

Applying this to energy markets

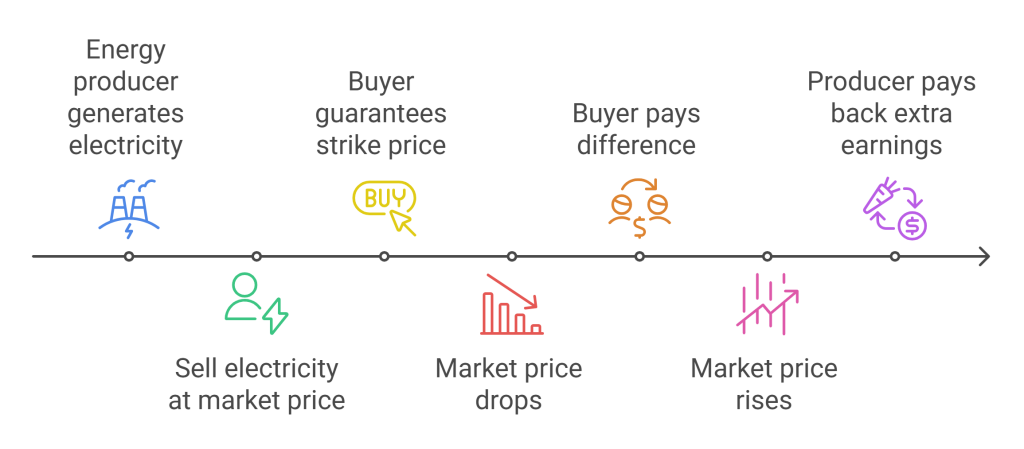

In the energy world, replace the fisherman with a wind or solar farm and the bank owner with a buyer (government, energy trader, or utility company).

- The energy producer generates electricity and sells it hour by hour on the market.

- The buyer guarantees a fixed price for electricity, regardless of the actual market price at that hour.

- If the market price at that hour drops below the fixed price, the buyer pays the producer the difference.

- If the market price at that hour rises above the fixed price, the producer refunds the difference to the buyer.

📢 A Contract for Difference (CFD) gives renewable energy producers price stability while allowing buyers to manage financial risk.

Now, let’s go back to our fishing village for a second. Did you know that the $5 fixed price in the bank owner’s deal has a name? And the actual price at the market has a name too?

They’re called the strike price and the reference price.

Let’s explain each! 🎣⚡💰

What is the strike price in a contract for difference (CFD)?

Remember our fisherman’s deal with the bank owner? He promised to always settle your fish sales at $5 per kilogram, no matter what the actual market price was.

That $5? It has a name.

💡 It’s called the strike price.

📢 The strike price is the fixed price agreed upon in a CFD. It determines how much the producer (seller) gets for their product, regardless of market fluctuations. ⚡💰

In our fishing village, the strike price was $5/kg. Some days you sold at $3, some days at $7, but after adjusting payments with the bank, you always ended up earning $5 per kilogram.

Now, let’s apply this to energy markets.

Strike price in energy CFDs ⚡

Electricity is not sold at one price per day, week, or month. Instead, prices change every hour on the wholesale electricity market, usually through a power exchange (like Nord Pool in Europe or PJM in the U.S.).

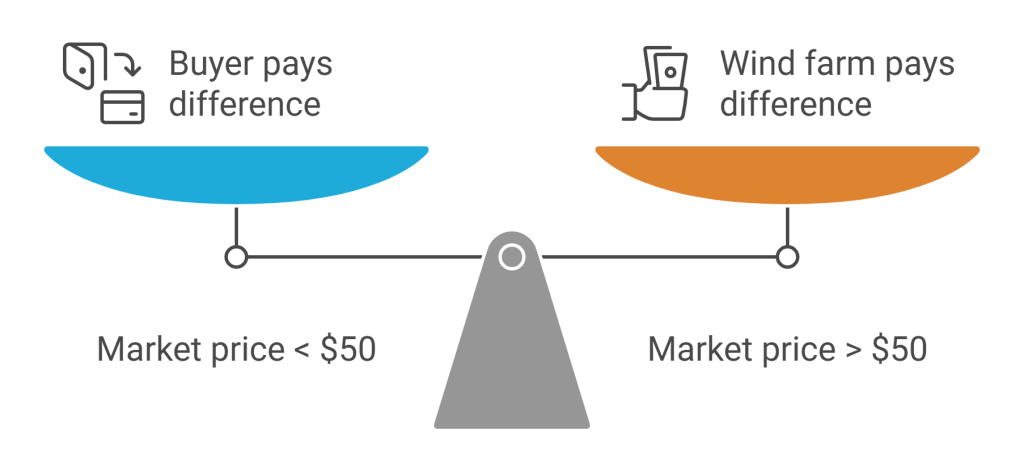

Let’s say a wind farm signs a CFD with a strike price of $50 per megawatt-hour (MWh). Here’s how it works:

- Every hour, the power exchange sets an hourly market price for electricity.

- If the market price for that hour is $45 (lower than $50), the buyer pays the wind farm the difference of $5.

- If the market price for that hour is $60 (higher than $50), the wind farm pays the buyer the difference of $10.

📢 The difference is calculated for every single hour of the year— 8,760 times per year (because there are 8,760 hours in a year).

Even though the wind farm is technically selling electricity at thousands of different prices throughout the year, its total revenue will always be:

💡 $50 × Total MWh produced

📢 In the end, the producer effectively sells electricity at the strike price, no matter how volatile the market is.

That’s why the strike price is sometimes called a “fixed price.” In the end, it’s the price both parties settle at—every single time.

Now that we understand the strike price, there’s one more key number in a CFD—the reference price.

Let’s dive into what that means! 🎯

What is the reference market price in a contract for difference (CFD)?

Alright, back to our fishing village. You remember the deal, right? The bank owner promised to settle your fish sales at $5 per kilogram, no matter what happened at the market.

But here’s a question: Which market?

Of course, you sell your fish in the village market every day. That’s where the bank owner checks the price to determine how much he needs to pay or collect from you.

But what if you decide to get clever?

💡 “Why should I sell only in the village?” you think. “What if I take some fish to the next village? Or maybe a big town with multiple markets? I’ll sell where prices are best!”

Sounds like a smart move, right? Well… not for the bank owner.

If you start selling in different places, the banker will go nuts trying to track the correct price. He can’t follow you around to seven different markets to check what price you got at each one.

So, to keep things simple, both of you agree: The village market will be the official “reference market” for determining the daily fish price.

📢 The reference market price is a pre-agreed benchmark that both parties use to determine how much money changes hands in the CFfD. ⚖️

Now, let’s apply this logic to energy markets.

Reference market price in energy CFDs ⚡

In a Contract for Difference (CFD) for electricity, the reference market price is the hourly price used to calculate payments between the producer and the buyer.

You might be thinking:

💡 “But isn’t this just the market price?”

Well… yes, but also no.

Just like with our fisherman, electricity doesn’t have just one market price—it depends on where you sell it.

Electricity producers can sell their power in different ways:

- On a national power exchange (wholesale market).

- Through regional electricity trading platforms.

- In bilateral contracts with big buyers like factories or data centers.

📢 To avoid confusion, a CFD contract always defines a single, transparent reference market price.

How it works in practice

- The reference price is typically the hourly wholesale electricity price in the country where the renewable energy project is located.

- It is publicly available, so both the producer and the buyer can verify it.

- It ensures both parties use the same benchmark, avoiding conflicts over which price to use.

For example:

- A wind farm in Germany signs a CFD with a strike price of $50/MWh.

- The reference market price is defined as the hourly price on the German power exchange.

- Each hour, the wind farm sells its electricity at that market price and settles payments based on the CFD formula.

This system ensures that everyone knows exactly what price is being used, just like our fisherman and the bank owner agreed to use the village market.

Now that we’ve got both the strike price and the reference price figured out, let’s see how they come together to make CFD payments work! 💰⚡

How to calculate the payments in a Contract for Difference (CFD)?

“Sure, that’s easy—just add or subtract, and that’s it!”

Yes, you are absolutely right. It’s really not a big deal when you break it down. However, in the energy market, where thousands of transactions happen every hour, certain common practices help make life easier.

One of those practices? Payments are usually made monthly rather than hour by hour. So, instead of settling 8,760 individual transactions (one for every hour in a year), the payments are bundled together and processed once a month.

But how exactly do we calculate what each party owes?

Let me give you an example!

A simple Contract for Difference (CFD) payment example ⚡

Let’s say we have a wind farm with a CFD strike price of $50/MWh. The reference market price fluctuates every hour, and at the end of the month, we need to settle the payments.

Step 1: Gather the hourly data

At the end of the month, we check how much electricity was produced each hour and what the market price was at that time.

Here’s a small snapshot of a few hours from our month:

| Hour | Electricity produced (MWh) | Market price ($/MWh) |

| 01:00 | 10 MWh | $45 |

| 02:00 | 15 MWh | $55 |

| 03:00 | 12 MWh | $48 |

| 04:00 | 8 MWh | $52 |

Step 2: Calculate the price difference for each hour

For each hour, we check how far the market price was from our strike price ($50/MWh).

- If the market price is below $50, the buyer must pay the producer the difference.

- If the market price is above $50, the producer must pay back the difference to the buyer.

Using our table above:

| Hour | Market price | Strike price ($50) | Difference | Buyer pays producer? | Producer pays buyer? |

| 01:00 | $45 | $50 | +$5 | Yes ($5 × 10 MWh) | – |

| 02:00 | $55 | $50 | – $5 | – | Yes ($5 × 15 MWh) |

| 03:00 | $48 | $50 | +$2 | Yes ($2 × 12 MWh) | – |

| 04:00 | $52 | $50 | – $2 | – | Yes ($2 × 8 MWh) |

Step 3: Sum up the monthly payment

At the end of the month, we repeat this process for all 720 hours in a month. The total balance tells us who owes whom and how much.

For example:

- If market prices were mostly low, the buyer ends up paying the producer a net amount.

- If market prices were mostly high, the producer owes money back to the buyer.

📢 Final Outcome: Even though electricity was sold at hundreds of different prices throughout the month, the producer’s total revenue will always be close to (strike price × MWh produced).

Is a Contract for Difference (CFD) a zero-sum game? Not quite! 🤔⚖️

At first glance, this might look like a zero-sum game, where one party’s gain is always the other party’s loss. But that’s not entirely true.

💡 Why? Because the strike price is not just a random number—it’s a carefully negotiated value that affects both parties.

If the strike price is set too high, the buyer might lose too much money when market prices are low.

If the strike price is too low, the producer might struggle financially when market prices drop.

📢 Therefore, both parties must carefully consider the strike price decision. It needs to be fair, sustainable, and aligned with market realities.

The key takeaway? CFDs are not designed to “beat” the other party—they are designed to create price stability in a market full of uncertainty.

But wait… Who decides the strike price? 🤷♂️💸

Good question! If the strike price is so important, how is it actually determined? Is it:

a) A mystical number whispered by an ancient energy guru? 🧙♂️

b) A wild guess from a corporate executive flipping a coin? 👨🏻💼

c) Carefully calculated using data, policy goals, and market conditions? 📊

Spoiler alert: It’s c (though, let’s be honest, some deals feel like b).

In the next section, we’ll dive into How the strike price is negotiated—and trust me, this part is where things get really interesting. Stay tuned! 🎯⚡

How is the strike price negotiated?

Alright, back to the negotiation table. You, the fisherman, now feel like a master negotiator. You walk into the banker’s office, confident and bold.

🐟 You: “Alright, banker, here’s my offer—I want a guaranteed price of $7 per kilogram for my fish.”

💼 Banker: Spits out his coffee “Excuse me?! Seven dollars?! Have you lost your mind?”

🐟 You: “Well, you said you’d buy my fish at a fixed price. Why not make it a good one for me?”

💼 Banker: Chuckles “Look, my friend, I’m trying to help you, not go bankrupt. The market price of fish is between $3 and $7 most of the time. If I agree to $7, I’ll be paying you top dollar even when the market is at rock bottom. That’s not a fair deal.”

🐟 You: “Hmm… fair point. What about $6?”

💼 Banker: “Still too risky for me. How about $3?”

🐟 You: Rolls eyes “Oh, come on, that’s robbery! I could make way more selling at the market.”

After some back-and-forth haggling, you both agree on $5 per kilogram.

📢 That price wasn’t just picked at random—it was carefully negotiated to make sense for both sides.

How strike price negotiation works in renewable energy ⚡

Just like in our fishing deal, renewable energy producers don’t just demand whatever price they want—they negotiate a price that is fair, competitive, and viable for their business.

But here’s the complication:

📢 Unlike fish, electricity is sold at 24 different prices every day on the wholesale market.

None of these prices are identical. They fluctuate based on:

- Supply & demand: higher demand = higher prices, and vice versa.

- Time of day: evening prices are high; nighttime prices are low.

- Seasons & weather: windy days lower prices (more wind power), cold snaps increase prices (higher demand).

📢 With thousands of different prices per year, choosing a single “fair” strike price isn’t so simple!

How the strike price is determined

In renewable energy Contracts for Difference, the strike price is typically based on:

📊 Historical market prices: looking at past trends to estimate a reasonable price.

📅 Future forecasts: predicting where electricity prices will go.

⚖️ Government policy & subsidies: Some strike prices are influenced by renewable energy incentives.

💰 Project financing needs: If a wind farm costs $500 million to build, the strike price must be high enough to keep it financially sustainable.

Two common methods for strike price negotiation

1️⃣ Auctions 🏆

- Governments or utilities host auctions, where energy producers compete for CFDs.

- The producer willing to accept the lowest viable strike price wins.

2️⃣ Direct negotiations 🤝

- Some contracts (like PPAs) are directly negotiated between producers and governments/utilities.

- The strike price is based on policy goals, project costs, and expected market behavior.

📢 The goal? To set a price that’s fair, sustainable, and encourages investment in renewables.

Why strike price negotiation matters

Just like the banker wasn’t going to agree to $7/kg for fish, buyers and sellers of electricity must carefully consider the risks and benefits of the strike price.

- If the strike price is too high, consumers and governments overpay for electricity.

- If the strike price is too low, energy producers may struggle financially and abandon projects.

📢 A well-negotiated strike price ensures that renewable energy remains both profitable and affordable.

Now that we’ve covered everything from what Contract for Difference (CFD) is to how payments work and how the strike price is set, it’s time to wrap things up.

Where is a Contract for Difference (CFD) used?

CFDs were actually born in financial markets, where traders use them to bet on stocks, commodities, and currencies without ever owning the actual asset. Wild, right? But since we’re all about energy here, let’s focus on where CFDs pop up in the world of electricity.

So, where can we find CFDs in action? Let’s break it down:

1️⃣ Renewable energy auctions 🏗️🌱

One of the biggest places you’ll find CFDs is government-led renewable energy auctions.

💡 How it works:

- The government holds an auction where energy producers bid for long-term contracts.

- The lowest bid that still makes sense for investment wins.

- The winning bidder gets a Contract for Difference (CFD) contract with a pre-agreed strike price.

🎯 Why? Because renewable energy needs upfront investment, and banks won’t fund a wind farm unless they know it’ll sell electricity at a stable price.

2️⃣ Power Purchase Agreements (PPAs) with CFDs 🤝⚡

Not all renewable energy projects rely on government-backed auctions. Some big companies want to secure their own clean electricity supply—so they sign PPAs (Power Purchase Agreements) with CFDs.

💡 How it works:

- A wind or solar farm agrees to sell electricity to a corporation, utility, or energy trader at a pre-agreed price.

- If the market price is lower than the PPA strike price, the buyer pays the difference to the producer.

- If the market price is higher, the producer pays back the extra revenue to the buyer.

🎯 Why? Many big tech companies use corporate PPAs with CFDs to power their data centers with 100% renewable energy at predictable costs.

3️⃣ Hedging in energy trading & industrial use 📈🏭⚡

CFDs also play a big role in energy trading and industrial energy consumption.

💡 How it works:

✔ Traders, utilities, and suppliers use CFDs to stabilize their costs when buying and selling electricity on the wholesale market, which changes every hour.

✔ Factories and large industrial consumers (like aluminum plants, steel mills, and data centers) sign CFDs to lock in a fixed electricity price and avoid financial shocks.

🎯 Why? Because energy prices can swing wildly in just a few hours. Without CFDs, a single bad month could ruin an energy supplier or send factory costs skyrocketing.

Why does this matter?

CFDs aren’t just theoretical finance tricks—they are used in real-world energy markets to:

- Fund renewable energy projects without massive risk.

- Ensure price stability for companies buying and selling electricity.

- Help industries hedge against unpredictable costs.

The key takeaway? CFDs don’t generate electricity—but without them, a lot of renewable energy projects wouldn’t even exist.

Final thoughts

So, what have we learned?

- That CFDs are basically a financial safety net for renewable energy producers.

- That electricity prices change more often than your grandma’s mood when you forget to call her.

- That fishermen and bankers would probably make decent energy traders. 😉

- And that negotiating a fair strike price is an art, a science, and sometimes a wild guessing game.

CFDs might sound complicated at first, but in reality, they keep the energy market from turning into a chaotic mess of unpredictable prices. And while they don’t generate electricity themselves, they make sure renewable energy producers aren’t gambling with their livelihoods every time the sun hides behind a cloud or the wind decides to take the day off.

Now, before we say goodbye, let’s keep the conversation going! Here are four questions to discuss in the comments:

- How are CFDs different from other types of renewable energy support mechanisms?

- CFDs stabilize energy prices, but they also mean producers don’t benefit when market prices skyrocket. Do you think that’s fair?

- What do you think happens when a CFD strike price turns out to be way off the mark?

- If you could make your own personal CFD for something in life (rent, gas prices, avocado toast), what would it be?

Drop your answers below—I’d love to hear what you think! And hey, don’t be shy—even if you just came here to figure out what CFDs are and ended up learning about fish prices instead, I promise, no question is too basic.

💬 Leave your thoughts in the comments below!And as always… stay curious! 🔍⚡😃